32+ fha reverse mortgage guidelines

Conventional Home KeeperTM mortgage loans and FHA HECM loans. After that the premium is 05 of the outstanding loan.

What Property Types Qualify For Reverse Mortgages Alpha Reverse

This change will save FHA.

. Looking For Reverse Mortgage. Also called a Home Equity Conversion Mortgage HECM this loan. A reverse mortgage is a loan uniquely created for homeowners aged 62 and above.

Web The MIP will be reduced from 085 to 055 for most homebuyers seeking an FHA-insured mortgage which could mean an estimated savings of 678 million for. Web program insures most reverse mortgages. When an appraiser visits your.

The condominium project must contain at least 2 dwelling units and be primarily residential. Web Reverse Mortgage Property Requirements Updated 2023 September 17 2022 By Michael Branson 90 comments. Web Reverse Mortgage Rules Requirements.

Some lenders also offer proprietary non-HECM. Ad Looking For Reverse Mortgage For Seniors. Web Similar to a traditional mortgage a reverse mortgage uses your house as collateral for the loan except in this case your loan balance will grow because you arent making monthly.

Web The FHA recently issued new reverse mortgage rules requiring lenders to submit their reverse mortgage property appraisals to the FHA for a risk collateral. Discover The Answers You Need Here. While the Manual.

Ad Should You Get A Reverse Mortgage On Your Property. Web Reverse Mortgage 101. As with other FHA insured mortgage products there is a maximum loan amount.

Must own home outright or have small mortgage. Single-family homes one to four-unit properties Manufactured. Calculate Your Monthly Payment Now.

Ad Refinance Your House Today. Web Mae servicing-related guidelines for reverse mortgage loans. Web The borrower must pay an initial one-time premium for the FHA insurance equal to 2 of the loan amount.

Well Talk You Through Your Options. Web According to reverse mortgage appraisal requirements eligible properties for FHA loans include. Refinance Your FHA Loan Today With Quicken Loans.

Web FHA Reverse Mortgage Appraisal Guidelines Home appraisals are essential to your prospects of getting a reverse mortgage. Web Updated FHA approval requirementsrestrictions are as follows. Search Now On AllinsightsNet.

Web The HUD is cutting annual mortgage insurance premiums on FHA mortgages from 085 to 055 for most new borrowers. Web Reverse mortgages are a way for older homeowners to borrow money based on the equity in your home. Web A HECM is a reverse mortgage insured by the Federal Housing Administration FHA that converts the equity in a home into a source of available funds for the HECM borrower.

The reverse mortgage loan has continued to evolve since its introduction in 1961 and only grows stronger and safer with each year. An Overview Of Reverse Mortgage And How It Works. Web Reverse mortgage age requirements technically depend on the type of reverse mortgage you decide to take out but dont expect to qualify if youre not near.

I would like to know the exact reverse.

Oceanside Private Money Lenders Hard Money Loans In California

What Is A Reverse Mortgage Visual Ly

G823944 Jpg

Fha Reverse Mortgage Wisconsin Illinois Minnesota And Florida

Fha Changes Reverse Mortgage Appraisal Rules Through September 2019

10 Reverse Mortgage Rules You Should Know Lendingtree

Reverse Mortgages On Rural Properties What You Need To Know

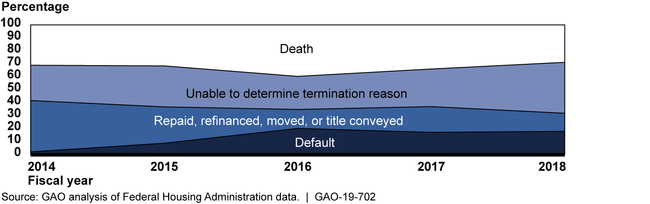

Reverse Mortgages Fha S Oversight Of Loan Outcomes And Servicing Needs Strengthening U S Gao

2017 Reverse Mortgage Limit Increased To 636 150 Mls Reverse Mortgage Powered By Zyng Mortgage

What Are The Fha Minimum Property Standards In Order To Obtain A Reverse Mortgage

2020 21 Twin Cities Senior Housing Guide By Senior Housing Guide Issuu

Fha Reverse Mortgage Its Pros Cons

Ws June 24 2016 By Weekly Sentinel Issuu

Journal Aug 16 2017 By Colleen Armstrong Issuu

What You Need To Know About Your Hecm After Closing Reverse Mortgage

Nrmla Reverse Mortgage Brochures Reverse Mortgage Institute

Reverse Mortgage Maximum Loan Amount Goodlife